Building the first home quote & buy journey

Design Lead • September 2022 - October 2023

Overview

Design lead for the digital experience of the quoting and purchasing journey for home insurance for a leading Canadian insurance company, The Co-operators.

Problem

With advisors shifting focus to other financial products, how do we attract a new type of client to purchase insurance online?

Quoting insurance requires over a hundred question for an insurance company to understand what is the right price you should pay and what your risk is for the company to take on. This project challenged our design team to breakdown this list of questions into a flow that was easy and efficient for clients to answer and not leave the experience.

The key was to find a balance between getting an accurate quote and asking the minimum amount of questions possible.

Goal

To design an inuitive quoting and purchasing experience with simplified complex insurance terminology, reduced questions and steps in the quoting process, and improve users understanding of their coverage. This solution needed to have high success rates for getting users to a quote quickly, high purchase conversions, and clear next steps for registration to their account.

Competitive analysis

When beginning to understand how to build out a flow that would meet both future prospects and our clients needs, our team conducted a competitive analysis of quoting insurance to understand some commonalities within the market.

Goals:

Identify the competitive landscape for property insurance & multi-product quoting (Auto & Home)

Questionnaire information architecture from competitors

Common themes and features from competitors

Quote page design & information architecture from competitors

Key Findings:

Property details are often the first set of questions competitors ask

Personal information is usually asked later in the workflow

Visuals are used with more challenging questions to remove ambiguity

Questions that require historical dates often allow for large ranges (e.g. was your roof replaced within the last 0 - 15 years?)

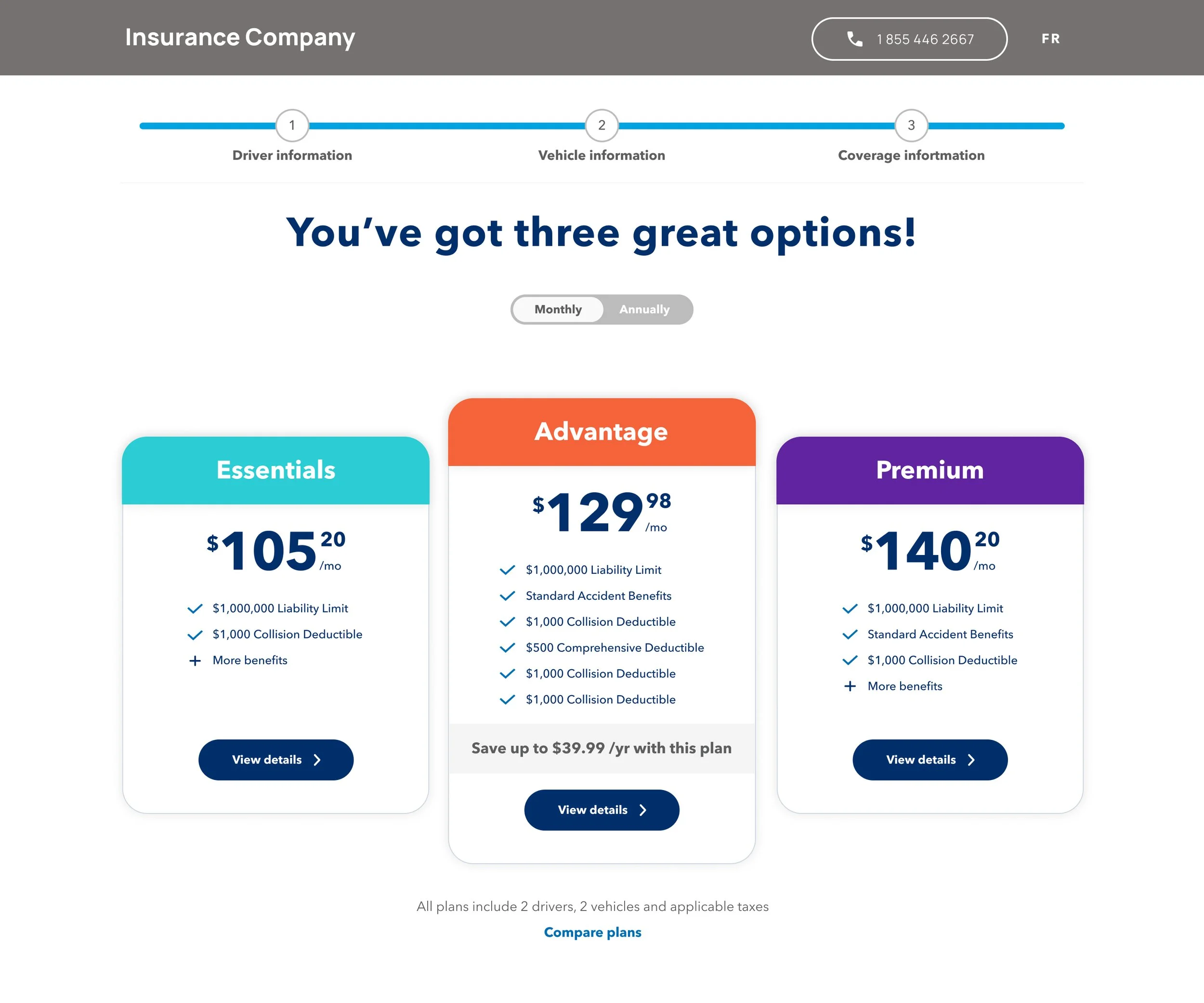

Majority of competitors produce one quote price instead of a tiered plan

Bundling opportunities to start another product quote was prompted on the quote display

Water related coverages were often given prominence on quotes

Lo-fi quoting questionnaire

From the competitive research conducted, our team was able to put a lo-fi quoting questionnaire flow together utilizing a qualtrics survey. This allowed us to quickly test our assumptions about what grouping and questions would resonate with users, and identify problematic questions to bring back to the client to workthrough with their underwriting team.

New branding and design system

In addition to building a new digital quoting and purchasing tool, our client was also building a new design system and visual brand. We utilized their new visual branding to build out an interim design system while the client developed their design system.

Ideation & Iteration

Our team produced designs with our new design system that were reviewed with the client with many iterations cycles before our team took the concepts into user testing.

User Testing

3 rounds of user testing were done for the home insurance product line. Prior to conducting testing a test plan is created to align with the client and team on:

Target users

What we want to learn

Any hypothesis we have

Desired outcomes

Sprint 1 Test Plan

15 min discovery interview • 45 min prototype test

-

If we prioritize a recommended package, users are more likely to understand the quote details and decide to enter the buy flow

-

Provide insights on areas of the questionnaire flow that are the biggest risk for drop-off.

Identify areas in property details that may confuse users and increase time on task

Understand behavioural insights of users for property insurance

Understand what information users want to know when being presented with a property quote plan.

How much detail is needed for coverage and any other questions users have

-

How confident are users about completing the overall flow, information, questions being asked and the context they asked in?

Are there any questions that cause issues for users? Such as, cognitive strain, privacy concerns, confusion?

Of the pre-fill property details, would users potentially modify any? Why?

How do users perceive where discounts are placed in the questionnaire? Contextually with corresponding questions or in their own sub-grouping?

-

Does the property quote page display the right information hierarchy for users?

What kind of information do users want to know for each coverage section? How much detail is needed?

Sprint 1 Test Insights

-

Questions that caused confusion were related to plumbing & wiring details and monitored systems in the home

Users commented on how answers to some questions would impact their price

Users were interested to know how property details were pulled and commented on the length of the property details page

-

Displaying quote packages with a priority on the middle package let to more work for users as they were often scrolling up to compare high level coverage and price

Modifying a quote, users liked seeing discounts applied to their quote, wanted more situational copy and were confused with coverage items that don’t have monetary amounts associated.

After customizing a quote participants felt compelled to go back to the quote packages and ensure they were still getting the best value

Participants expected auto-recalculation

Utilizing a “shopping cart” page felt natural for users and allowed for scalability

Sprint 4 Test Plan

15 min discovery interview • 45 min prototype test

-

Quote display: When users are viewing the quote display, they will be able to identify and understand mandatory versus optional coverage.

Bundling: Users will find the additional page and high level detail creates a simplified user experience, preventing them from feeling overwhelmed with information

Purchase decision: Users will feel they have been provided enough context and information to move forward with purchasing their selected insurance.

-

Test end to end workflow and validate users understand all questions

Validate copy for end to end workflow is clear

Test if users are motivated to look into the multi discount and what information they need to make a decision

Test if users know how to add the multi discount and get an auto quote from a home quote display

Sprint 4 Test Insights

-

Overall, participants were confident completing a quote. Majority of users indicated they felt “very comfortable” purchasing home insurance from Co-operators.

Reduce number of questions related to property details that are not visible. Most participants struggled to answer “Electrical wiring” and “year plumbing was replaced”.

In-context copy was an effective tool for users to understand questions and coverages. E.g. Participants were willing to consent to credit checks because they understood it would provide an accurate quote

Participants were receptive to bundling on the quote display. It was assumed that savings would be applied after they completed their auto insurance quote.

Sprint 10 Test Plan

15 min discovery interview • 45 min prototype test

-

How do users find the steps of moving from the quote coverage to the buy flow for home

How do users react to the pre-qualification questions?

How familiar are users with the loss prevention device questions?

Do users comprehend that there is an account being set-up for them when they buy?

Are there any moments of tension that disrupt the user from continuing the buy flow?

How do users react to the pre-qualification questions?

Do users understand if they need to add an additional deed holder?

Are users confident in their financial institution address? If not, how will they find the information?

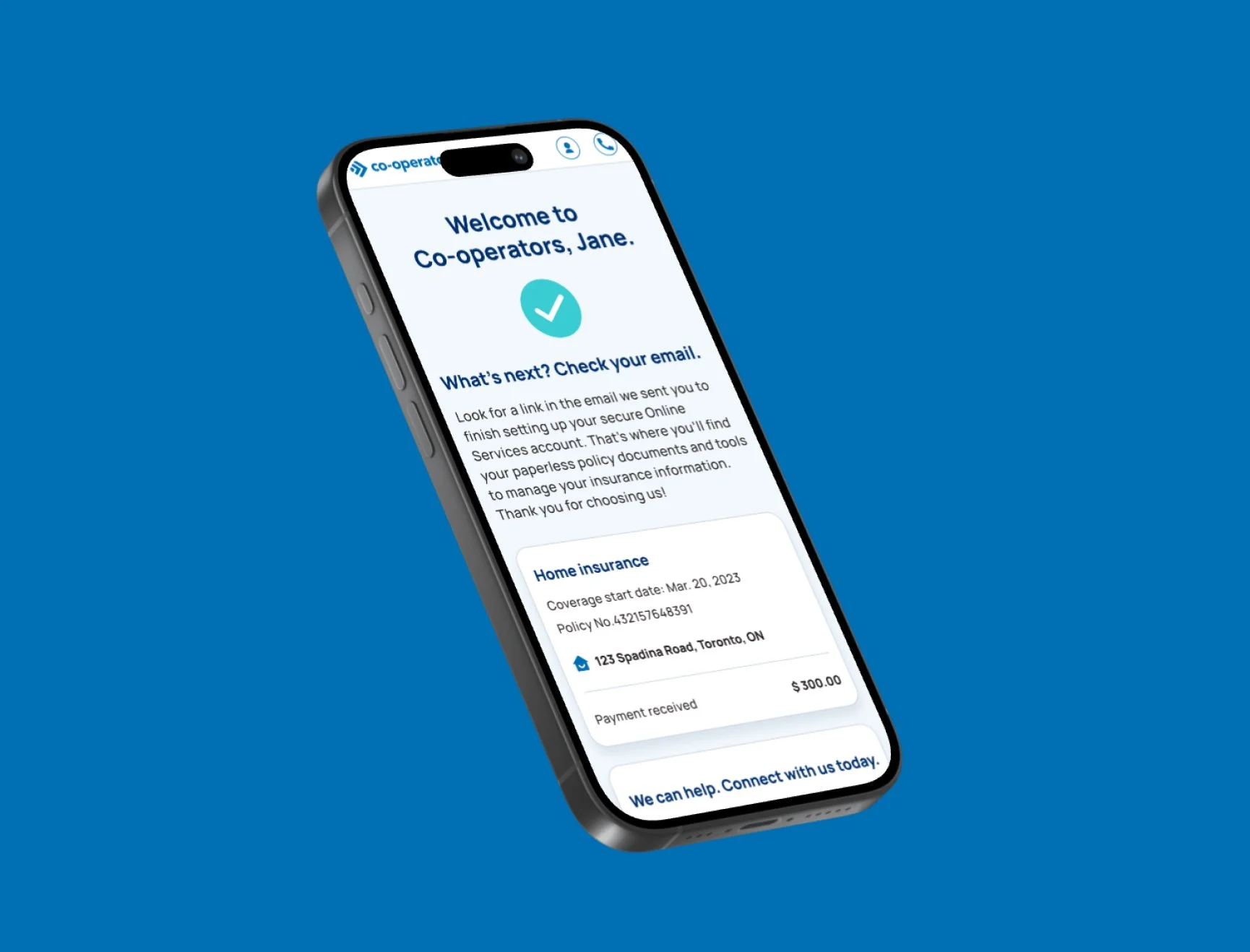

How do users interpret account set-up [i.e. do they believe they've created an account or that there will be a next step of creating a password (this comes in the email after)]?

What are users expectations around payment methods for single and bundle purchase

If users choose to pay monthly, do they understand why we are collecting both financial information types?

How do users react to the initial vs. recurring payment set-up?

Sprint 10 Test Insights

-

Users were able to complete the buy information gathering. Most users commented that the experience was straight forward.

Single payment schedule for two policies was preferred. If users did want separate payments, they could purchase individually.

Correct placement of help modals. If users experienced confusion and utilized a help modal, they were often confident in their understanding afterwards.

Questions that are likely to require users to leave workflow should be monitored. Branch address and loss prevention devices often make participants check documentation or utilize Google.

Quoting vs. Buying timelines may create user drop off. Requiring a user to re-engage to purchase for a quote past 30 days should be monitored.

Copy adjustments to sections for private lenders & account creation. Adjustments to copy will improve users understanding of items around loan information and when their account is being created.

Outcome

Home Quote Performance

30.5 K total quote starts

8.3 K total quotes fully generated

20% of all quotes started via digital

46% of quotes were homeowner

Average quote time was 2 min 44 sec

Home Purchasing Performance

Average time from quote to buy was 5 min 52 sec.

67% of quote buys were tenant

$390 K generated